Should utility interactions and payment plans be more like banking or more like phone service? I recently heard a speaker make both analogies about the energy industry and the way it should serve customers. I think both directions are tempting models, however, after examining both, I believe there could be a third way.

The first analogy highlights significant access and informational shifts that have occurred in the banking industry. Forty years ago, customers could only access their financial information and their money only during limited “bank hours”. Thanks to the proliferation of ATMs in the 1970s, customers could access their money any time of the day. Now, thanks to the internet and smartphones, customers have unlimited access to their financial information day or night. I can transfer funds, pay bills, and check my balance 24/7. It’s easy and empowering to have that level of monitoring and control. Has this shift in practices led to significantly smarter purchases? Increased savings accounts? That’s not as clear.

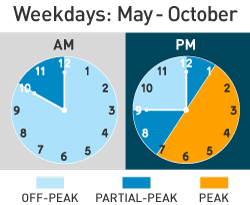

This is the direction that utilities have been headed in the past few years with online portals that give customers access to their current and historical usage at any time, not just once a month when the bill comes.  Time of use pricing and demand response programs send price signals to customers about when it is more and less expensive to use energy. This suggests a version of a utility customer that is savvy about their energy use, aware of energy prices, and understands, in a detailed way, how their bills reflect their actions. These energy customers are the epitome of the rational actor. For many people, these changes have been appreciated and are a valuable part of their customer satisfaction. But could we do more?

Time of use pricing and demand response programs send price signals to customers about when it is more and less expensive to use energy. This suggests a version of a utility customer that is savvy about their energy use, aware of energy prices, and understands, in a detailed way, how their bills reflect their actions. These energy customers are the epitome of the rational actor. For many people, these changes have been appreciated and are a valuable part of their customer satisfaction. But could we do more?

The same speaker also suggested that maybe energy should be viewed more like modern phone service. Even just 20 years ago, while in college, I carefully planned when I made long distance phone calls to family and friends. Sunday nights were the least expensive. Daytime during the week was most expensive. Calls could only be made from the landline that I shared with a roommate. Now, mobile phone plans have unlimited calling and phone calls can be made from (nearly) anywhere. It’s easy, it’s low stress, and I appreciate not having to schedule my days around when I can afford to call grandma. Technology improvements and consumer demand has made it possible for people to call and text and download without restriction. As any parent of teenage children can attest–when price constraints are removed, data usage can spike astronomically.

This vision of the utility customer of the future seems at odds with the first analogy. This customer is not thinking about when or how much energy they are using. As an energy-efficiency proponent, I found this vision somewhat alarming. I want customers to have informed control over their energy use. But, I admit that I also like things that are easy and do not require a lot of scheduling and decision-making.

The third way may likely be to monitor energy more like fitness trackers. The genius of fitness trackers is that while they provide detailed information to those who want to get into the weeds, it does not assume that all people are perfectly rational actors. Mostly we want to do the cost effective and globally beneficial action, but sometimes we need a little nudge. Fitness trackers provide a startling simple metric to encourage users to be active. I’m sure 10,000 steps is not the exact magic number for every person, but it’s easy to remember, is achievable for many people, and feels like a noble goal has been met when the tracker alerts you to your accomplishment. How can we translate this to energy? Perhaps an app that congratulates you each day when you’ve kept your energy use below a target level? This strategy leverages sound behavioral principles of positive reinforcement; break down behavior change into simple and achievable measures that, when accomplished, trigger automatic positive rewards. Unlike the banking example, which may not impact behavior change at all, and the phone example, which incentivizes over-use, this model uses technology to simplify our goals and keeps us moving in the right direction.